Payroll withholding calculator

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. 250 minus 200 50.

How To Calculate Federal Income Tax

The Withholding Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck.

. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Free Federal and State Paycheck Withholding Calculator. You can use the Tax Withholding.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

For example if an employee earns 1500. Federal Salary Paycheck Calculator. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. You assume the risks associated with using this calculator. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Subtract 12900 for Married otherwise. How It Works.

The information you give your employer on Form W4. For help with your withholding you may use the Tax Withholding Estimator. Instead you fill out Steps 2 3 and 4.

Then look at your last paychecks tax withholding amount eg. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Subtract 12900 for Married otherwise.

Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand. Estimate your federal income tax withholding. That result is the tax withholding amount.

See how your refund take-home pay or tax due are affected by withholding amount. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Thats where our paycheck calculator comes in.

250 and subtract the refund adjust amount from that. Use this tool to. The reliability of the calculations produced depends on the.

Fill in the employees details. Heres a step-by-step guide to walk you through the tool. Computes federal and state tax withholding for.

The Withholding Calculator helps you. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. 2022 Federal income tax withholding calculation.

It will confirm the deductions you include on your official statement of earnings. 2020 Federal income tax withholding calculation. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

How to calculate annual income.

Calculation Of Federal Employment Taxes Payroll Services

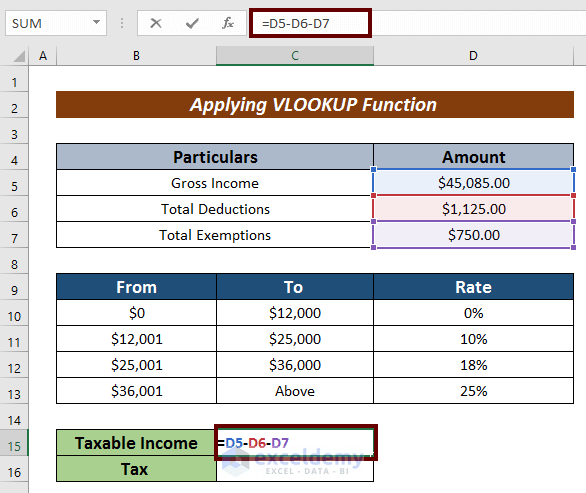

Excel Formula Income Tax Bracket Calculation Exceljet

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Income Tax In Excel

How To Calculate Payroll Taxes Methods Examples More

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Withholding Tax Youtube

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

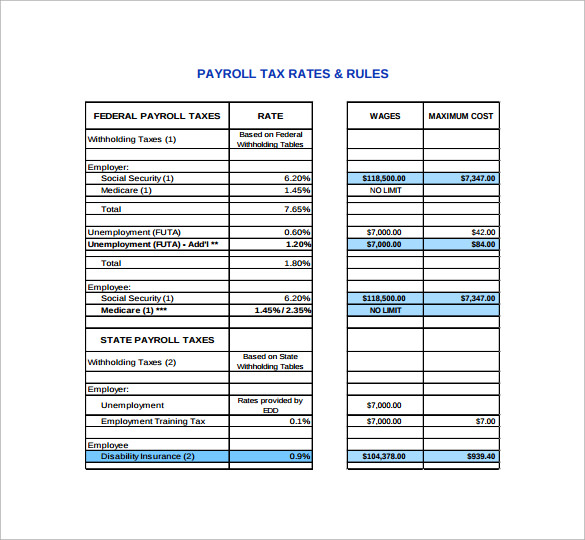

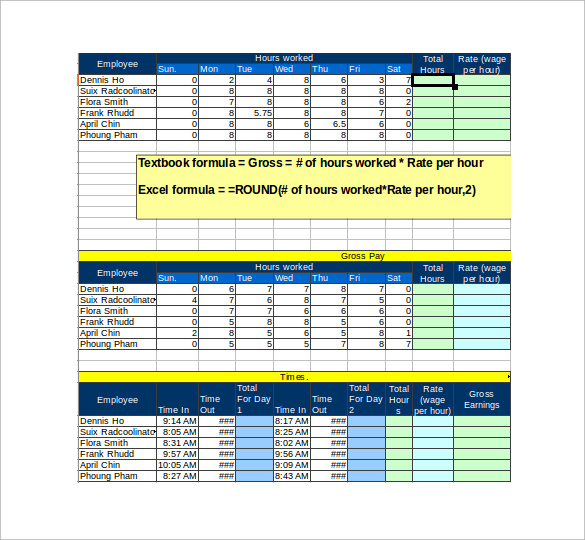

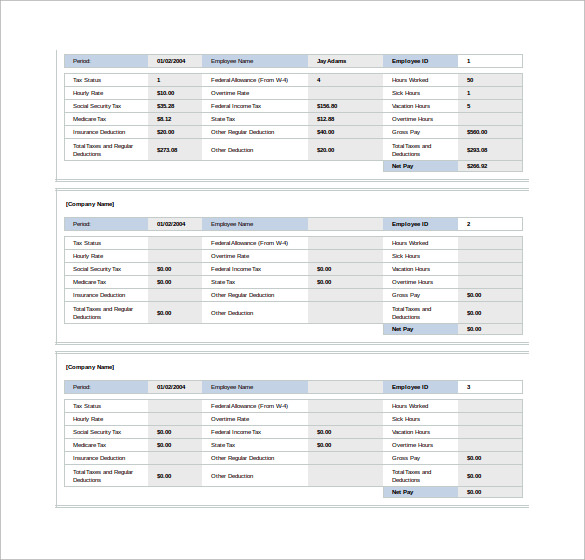

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

How To Calculate 2019 Federal Income Withhold Manually

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Paycheck Calculator Take Home Pay Calculator

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Tax Withholding For Pensions And Social Security Sensible Money